north dakota sales tax nexus

North Dakota took place in North Dakota in 1992. North Dakota states now seem to be.

Economic Nexus And The Future Of Sales Tax Avalara

200000 in sales only as of January 1 2019.

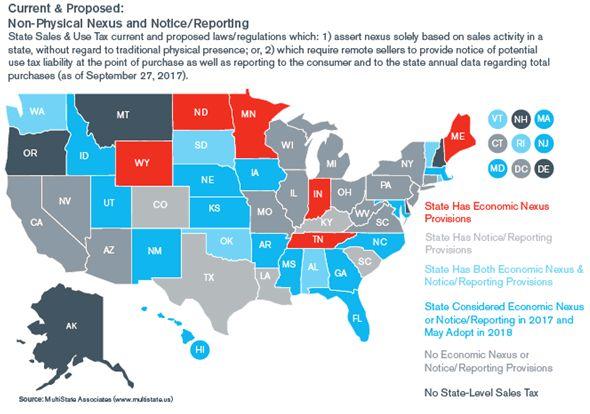

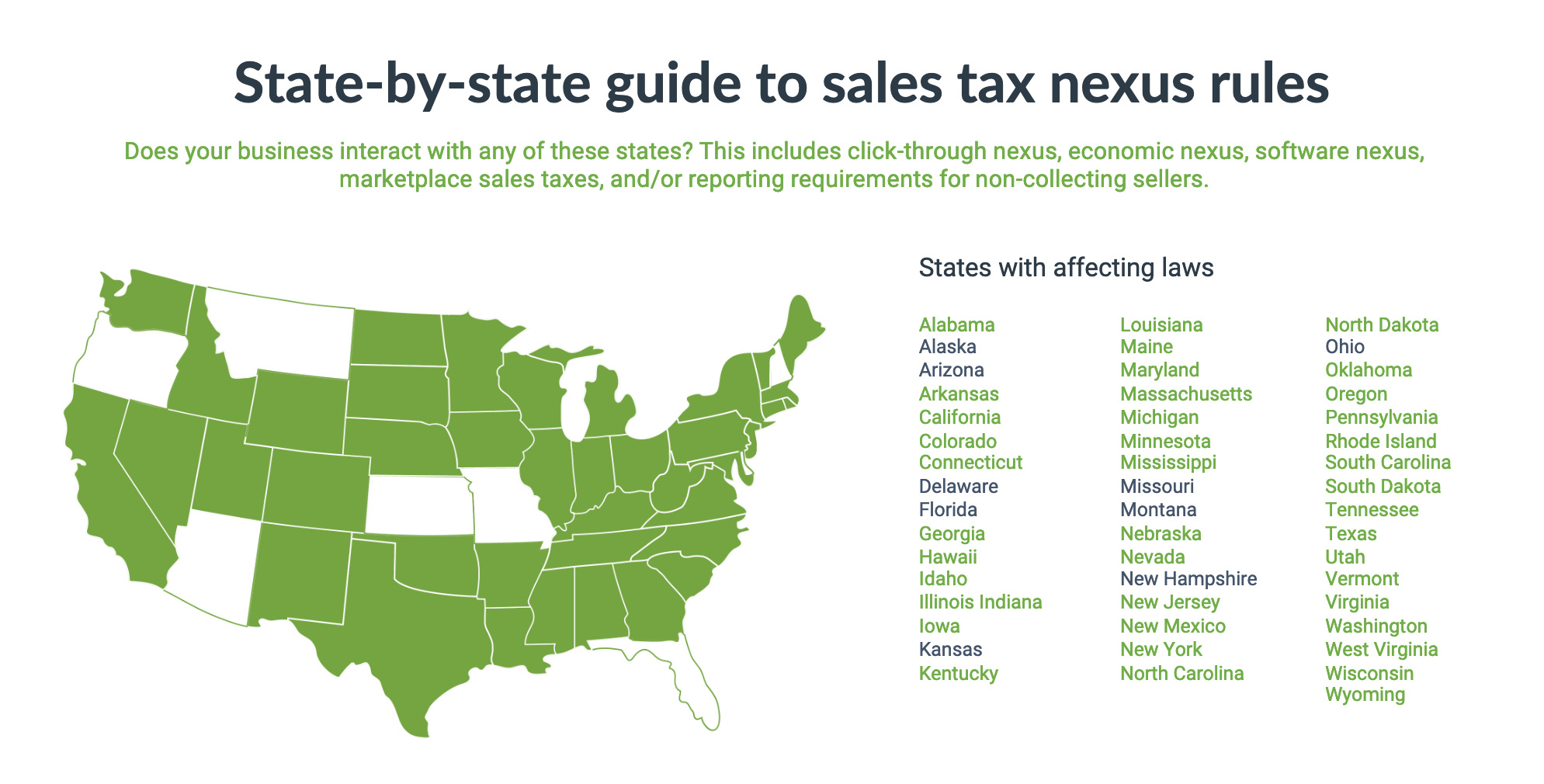

. As a retailer it is important to know about state tax nexus laws so you can be prepared in case your online sales pass the. This page describes the taxability of. Effective October 1 2019 North Dakota has enacted marketplace nexus provisions.

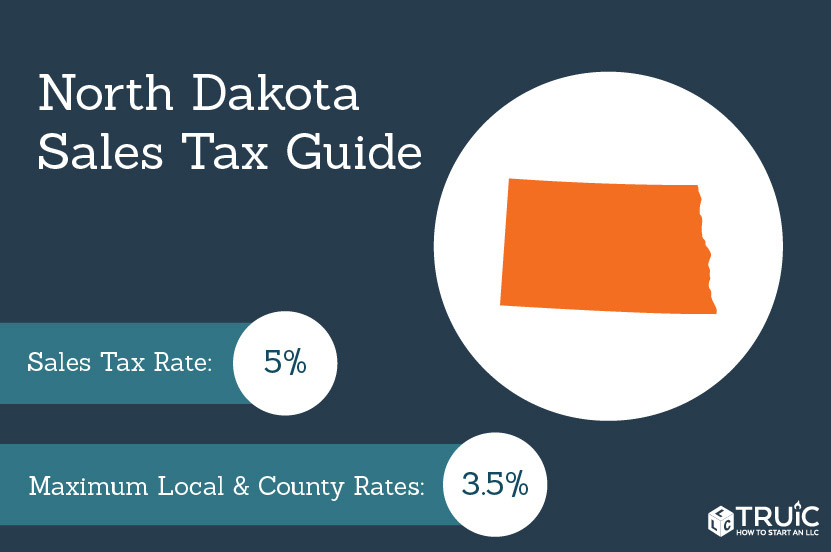

North Dakota sales tax is comprised of 2 parts. To review the rules in North Dakota visit our state-by-state guide. Understand how your online business can be exposed to tax risk.

So no matter if you live and run your business in North Dakota or live outside North Dakota but have nexus there you. While North Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. After June 30 2019 those remote sellers may cancel their North Dakota sales and use tax permit and discontinue collecting North Dakota sales tax.

150000 in sales only as of January 1 2020. 52 rows The first day of the month following 30 days from adoption by the city or borough. Look up 2022 sales tax rates for Erie North Dakota and surrounding areas.

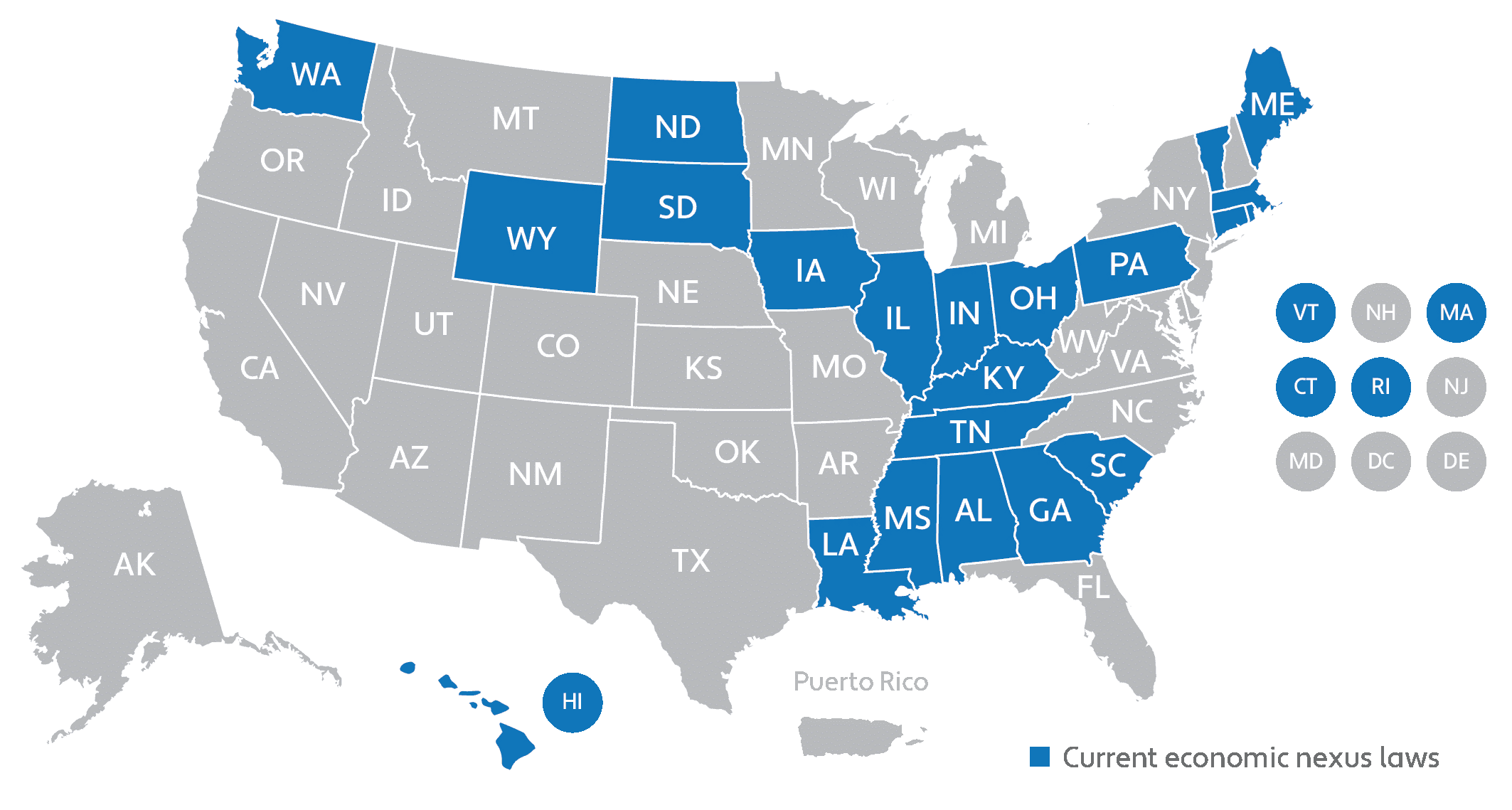

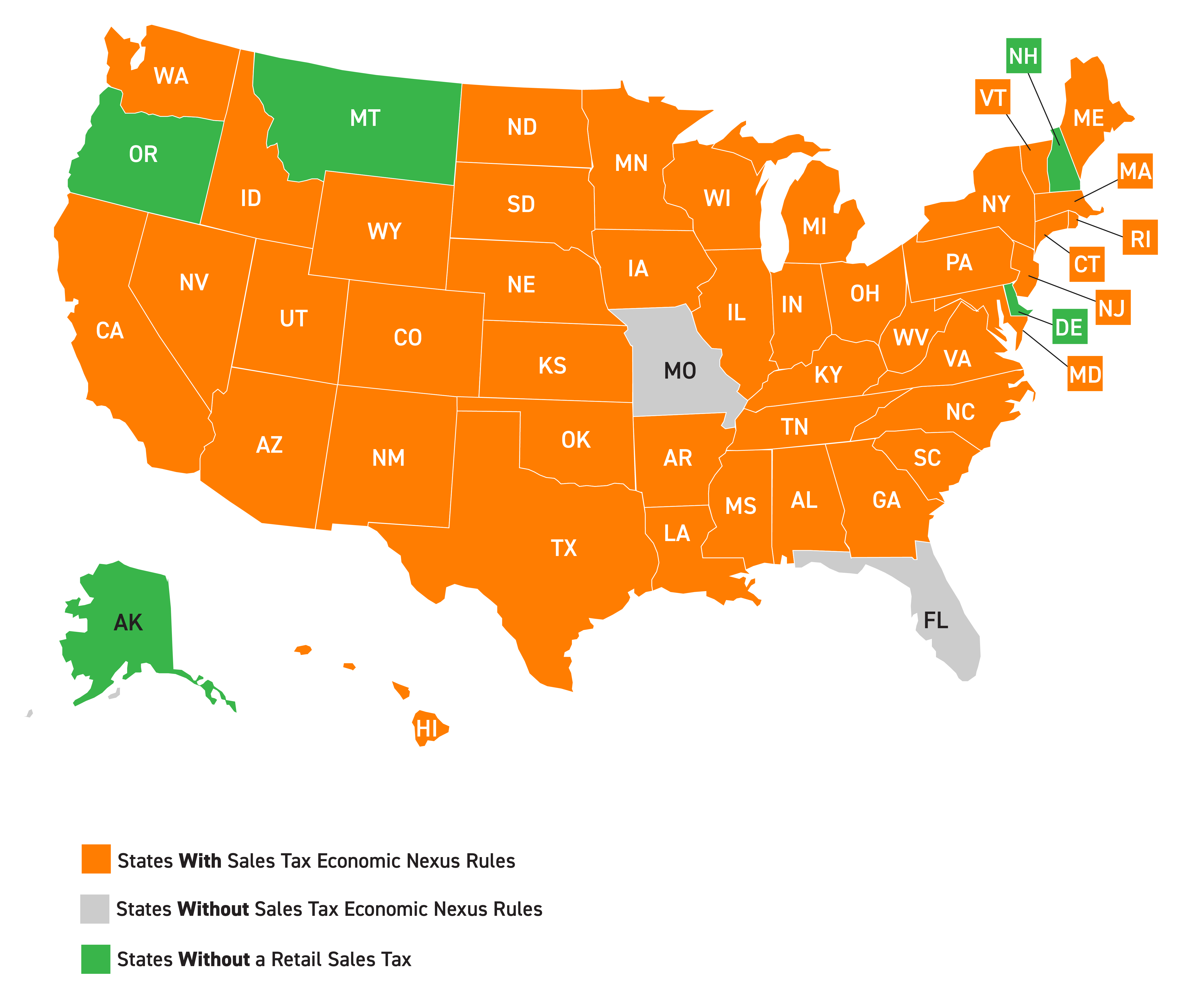

In the 2018 Supreme Court case South Dakota vs. Sales Tax Nexus Nexus A level of connection between a taxing jurisdiction and an entity. 2018 Supreme Court Ruling Regarding Online Sales Taxes.

North Dakota first adopted a general state sales tax in 1935 and since that time the rate has risen to 5. Sales Tax Nexus in North Dakota. 35250 Plus 355 of Amount Over 25000.

State Sales Tax The North Dakota sales tax rate is 5 for most retail. Has impacted many state nexus laws and sales tax collection requirements. Wayfair Inc Et Al the court overturned a previous ruling that required a.

The former Nexus rule was defined through a physical presence in a state which meant that you qualify for Nexus if you The Supreme Court case ruling of South Dakota v. North Dakota is a destination-based sales tax state. Marketplace facilitators without a physical presence in North Dakota are.

If a corporation elects to use. On March 14 2019 the North Dakota Governor signed SB. Tax rates are provided by Avalara and updated monthly.

If your business has an office or any other. You can read about North. 1240 Plus 431 of Amount Over 50000.

According to the law of North Dakota all retailers who have tax nexus can be defined in several different ways. 2191 which eliminated the 200 transaction sales tax economic. The general sales and use tax rate and the motor vehicle excise tax rate was increased from 55 to 6.

Required before a taxing jurisdiction can impose its taxes on a business. Wayfair represented the culmination of decades of state efforts to overturn the physical presence standard in sales tax under Quill v. The rate on farm machinery irrigation equipment farm machinery.

The sales tax is paid by the purchaser and collected by the seller. Skip to main content. 141 of North Dakota Taxable Income.

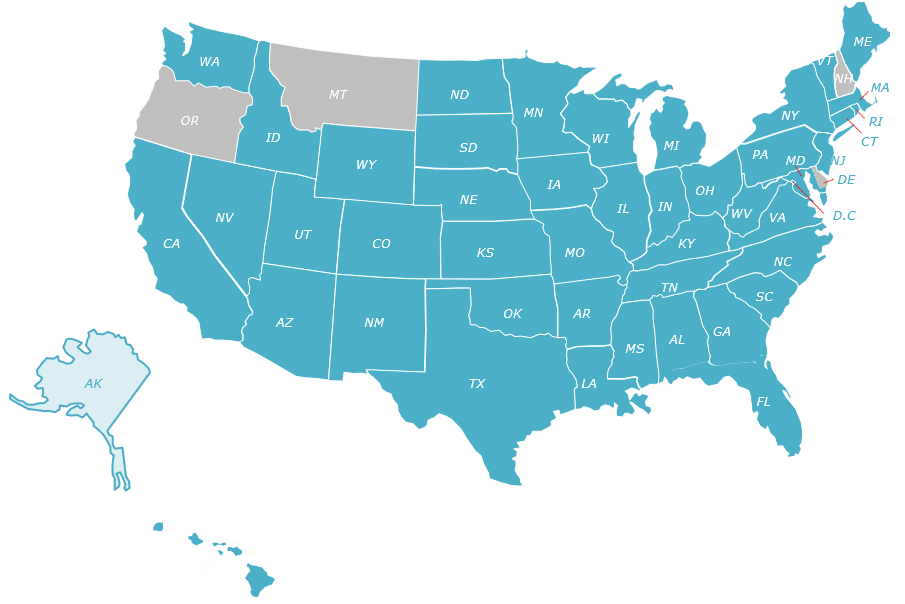

The North Dakota Office of State Tax Commissioner is pleased to announce the launch of its new website wwwtaxndgov. Out of state sales tax nexus in North Dakota can be triggered in a number of ways. Alaska Remote Seller Sales Tax Commission Economic Nexus Rules.

Some state thresholds are only 10000 and some are 500000. One of the foundational court cases regarding sales tax nexus Quill Corporation v. On top of the state sales tax there may be one or more local sales taxes as well.

Read North Dakotas full notice here. A marketplace facilitator without physical nexus in North Dakota that reaches the 100000 threshold for the first time in the current calendar year must register and begin collecting tax. Wayfair Inc and its decision to allow the state to enforce tax collection from remote sellers.

100000 in sales only as of January 1 2021. In reaching this decision the North Dakota Supreme court overturned its prior decision from 1992. View our complete guide to North Dakota sales tax with information about ND sales tax rates registration filing and deadlines.

With the launch of the new website also comes. Due Process Clause and.

Business Guide To Sales Tax In North Dakota

Current Trends In Income Tax And Sales Tax Nexus Corvee

North Dakota Sales Tax Handbook 2022

Sales Tax Just Got A Lot More Complicated Are You Ready Teampay Teampay

South Dakota Defeats North Dakota Ends Physical Presence Sales Tax Nexus Debate Carter Shelton Jones Plc

South Dakota V Wayfair How A Supreme Court Case Is Revealing A 26 Year Old Congressional Dormancy Regarding Interstate Online Sales Tax Roosevelt Institute Cornell University

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

North Dakota Sales Tax Small Business Guide Truic

Sales Tax Nexus 5 Signs Your Company May Owe Taxes In Other States Stage 1 Financial

U S Supreme Court Overturns Physical Presence Test Giving States Authority To Collect Sales Tax From Remote Sellers Butler Snow

North Dakota Sales Tax For Photographers

Redefining Online Sales Tax South Dakota Vs Wayfair And New Tax Compliance

Out Of State Sales Tax Compliance Is A New Fact Of Life For Small Businesses

Economic Nexus And The Future Of Sales Tax Avalara

How To File And Pay Sales Tax In North Dakota Taxvalet

How To Register For A Sales Tax Permit In North Dakota Taxvalet